Table Of Content

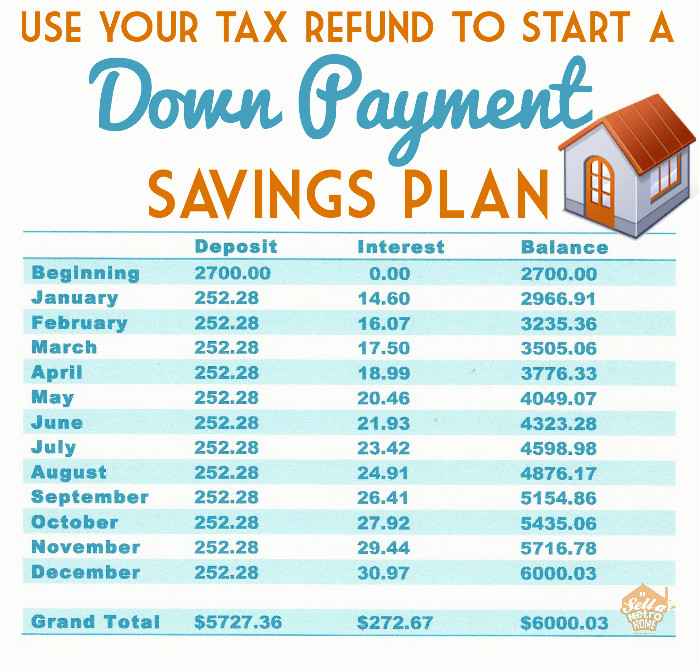

You currently have no savings, so you will need to save $100,000 over the next five years. If your bank doesn’t offer a round-up program, you can use third-party apps. For $3 per month, or $5 per month with a family plan, you can link your credit cards and debit cards from any financial institution and automatically invest your round-ups.

Fixed-Rate vs. Adjustable-Rate Mortgages (ARM)

When you make an offer on a home, earnest money is paid as a sign of good faith to the seller, demonstrating your serious interest in the property. It’s held in an escrow account and is credited towards your down payment at closing. If you don’t have the amount of money necessary for the down payment on a $300K house, rest assured that there are solutions. As mentioned earlier, down payment assistance (DPA) programs offer home affordability programs tailored to individuals with low to moderate household incomes. You can use a mortgage calculator to model your own housing payments using today’s mortgage rates.

VA Loan Down Payment

A fixed-rate mortgage is ideal if you want your monthly payment to stay the same, but an ARM could be a good option if you are buying when interest rates are high. When you apply for a conventional loan, you can decide whether you want a fixed-rate mortgage or an adjustable-rate option. A fixed-rate loan has the same monthly mortgage payment from the start of the loan to the end. Your lender might adjust your payments based on your taxes and insurance, but there won’t be any adjustments based on interest rates. However, home-buyers must pay an upfront mortgage insurance premium at closing that is worth 1.75% of the loan amount, on top of the down payment. In addition, monthly mortgage insurance payments last for the life of the loan unless refinanced to a conventional loan.

What can you afford to spend on a house? Try our SoCal-specific calculator.

PMI is added to your monthly mortgage payments, so you would pay a fee of $49.50 to $506 on top of your standard loan. When setting your sights on a $300,000 home purchase, it’s important to grasp the concept of your debt-to-income (DTI) ratio and how it fits within the framework of loan limits. Your DTI ratio represents the chunk of your gross monthly income (pre-tax) that is allocated towards your comprehensive monthly debt responsibilities. This encompasses your housing payment (principal, interest, property taxes, and insurance) along with any additional debts, such as credit cards and car payments. Most home loans require at least 3% of the price of the home as a down payment. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment.

A 24-year-old with over 300,000 TikTok followers breaks down how she worked side hustles to buy a house—and ... - Yahoo Finance

A 24-year-old with over 300,000 TikTok followers breaks down how she worked side hustles to buy a house—and ....

Posted: Mon, 15 May 2023 07:00:00 GMT [source]

This figure represents the maximum recommended housing payment for your income level, including principal, interest, property taxes, home insurance premiums and any applicable HOA fees. Every borrower’s situation is different, but many lenders adhere to the 28/36 rule when evaluating applicants. This specifies that no more than 28 percent of your gross income should be spent on your monthly housing payment, and no more than 36 percent on total debt payments, including housing. These programs are eligible for most conforming loans such as FHA Home Loans, VA loans, and USDA loans. Conforming loans that are insured by Fannie Mae and Freddie Mac are also eligible for such programs. Many state-wide mortgage programs provide down payment assistance through local housing authorities backed by the FHA.

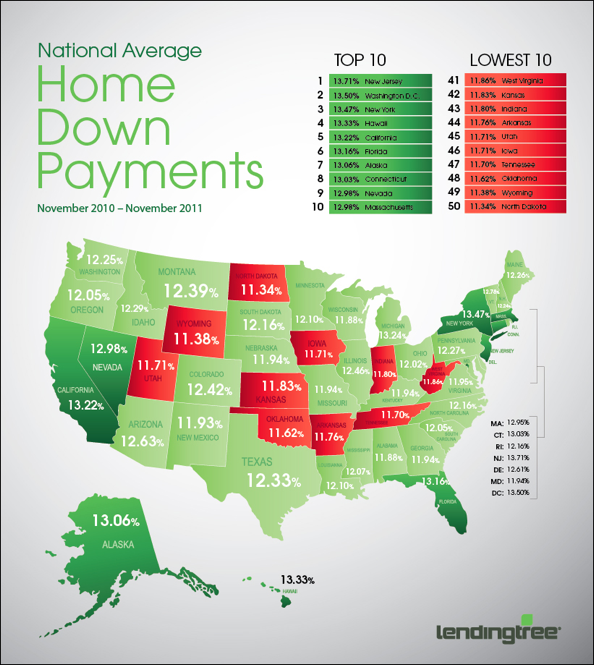

PMI will compensate the lender if the borrower defaults on the loan. In most cases, borrowers pay for PMI as a monthly premium that is added to their mortgage payment. In fact, many people do put down less than 20% when buying a home. The median down payment for all US homebuyers in 2023 was 14% of the purchase price, according to The National Association of Realtors. The average down payment varies a great deal depending on the age of the buyer, as well. One of the highest yields for a checking account is offered by La Capitol Federal Credit Union, which operates in Louisiana.

Fixed rate vs adjustable rate

These loans are also preferred when you can lock in a lower interest rate. Talk to your lender if you think you will need different loan options to accommodate special cases. It’s worth asking your lenders for both 15-year and 30-year proposals to see what kind of difference they make in your monthly payments.

In 2024, that means any conventional loan that exceeds $766,550 in most markets — though high-cost areas have higher limits, up to $1,149,825. Because of their size, jumbo loans typically require 10 percent down or more. With a 5% down payment option, you may be eligible for an FHA loan or a conventional mortgage, but you will need to pay for PMI. Yes, earnest money typically goes toward the down payment on a house.

$300K earners in Vancouver need 38 years to save up for a home Urbanized - Daily Hive

$300K earners in Vancouver need 38 years to save up for a home Urbanized.

Posted: Tue, 06 Jun 2023 07:00:00 GMT [source]

Keep your debt-to-income ratio low

Note that mortgage insurance on FHA loans is applied differently and can be more difficult to get rid of without refinancing. Mortgage payments are amortized, which means the size of the payment (on a fixed interest-rate loan) stays the same throughout the repayment period. The amount going toward interest gradually decreases while the amount going toward principal gradually increases. Each payment builds equity though and you will build equity faster if you start off with a larger down payment. Mortgage lenders require a down payment as protection against a borrower defaulting.

However, if you’re eligible for either a VA loan or USDA loan, you can buy a house without any down payment. “High rates are making buyers rethink their priorities, as many of them can no longer afford the home they want in the location they want,” said Chelsea Traylor, a Redfin agent. To help point aspiring homeowners in the right direction, the team at Prevu Real Estate gathered the answers to the key topics buyers ask about when saving for a down payment.

A down payment is the upfront portion of a payment that is often required to finalize the purchase of items that are typically more expensive, such as a home or a car. When purchasing a home, after a down payment is paid by a home-buyer, any remaining balance will be amortized as a mortgage loan that must be fulfilled by the buyer. In other words, the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Often, a down payment for a home is expressed as a percentage of the purchase price.

The required credit score to buy a $300K house typically ranges from 580 to 720 or higher, depending on the type of loan. Conversely, conventional loans generally require a minimum score of 620, but securing more favorable interest rates often demands a score above 720. Buyers seeking a conventional mortgage loan with low down payments will likely require PMI - more formally known as private mortgage insurance. PMI is required when a buyer requests a loan from a mortgage lender with a down payment of less than 20%. Figuring out your credit score helps determine what percentage of purchase price lenders may require for a down payment.

No comments:

Post a Comment